Our empirical ndings show that the Black-Litterman model is suitable for investment managers committing to the CAPMYou have been assigned to evaluate the stock market performance of firms who manufactures accounting This course gives an overview of applying Excel in a most efficient manner for typical calculations in investment analysis and portfolio management. This holds true for the larger portion of occa-sions when modifying key input variables such as transaction costs, risk aversion, certainty level and time horizon. Text in the Black-Litterman model.

Using Excel for factor analysis? Analyze factor exposures and return and risk contributions in Venn. A tutorial on how to build a stock portfolio in Excel with realtime data from Yahoo Finance. The Campaign Portfolio Template that is free is the ideal means to organize all your job campaigns for your business.

The FTS Real Time Client’s Black-Litterman Model (BLM) calculator then constructs the The FTS implementation is fairly easy, and works as follows: You specify the stocks/ETF’s you want to work with and data about these stocks. The intuition behind the model is described in a paper by He and Litterman. Models (30 min 28 sec) × Black-Litterman Portfolio Optimization.

The optimal portfolio consists of a risk-free asset and an optimal risky asset portfolio. The lecture notes titled “Portfolio Theory with Matrix Algebra”. First, type the six categories for the columns into row 1. This portfolio is optimal because the slope of CAL is the highest, which means we achieve the highest returns per additional unit of risk. Note that σ 12 means the variance of asset 1 A Microsoft Excel project portfolio management template that will help you to achieve your organization’s goals. Additional Sample Spreadsheets.

Black Litterman Excel Example Download Return On

Where w 1 to w n are the weights of assets 1 to n in the portfolio, and σ xy is the covariance between assets x and y. Real estate investment analysis free download return on, valuing a mortgage portfolio with cash flow analysis excel cfo, investment portfolio excel template Investment portfolio analysis excel template. Access Free Portfolio Analysis Excel And Vba appears as a "black-box" software application. For example, there are commercial add-ins that can download historical stock quotes into Excel and provide tools for analyzing the information, creating charts, and providing oodles of technical analysis functions. While we plug in initial place holder allocation values to test the models, the actual portfolio allocation will be done by Excel Solver based on a model we specify. Provides reference to earlier versions of Excel and VBA, and includes a CD-Rom with modelling tools and working versions of models discussed.

If you have spreadsheet software (on your PC desktop or in the cloud), you can conduct portfolio risk analysis. Note that σ 12 means the variance of asset 1 Excel Portfolio Performance Tracking Template, Excel Multiple Regression Analysis and Forecasting Template: Find more Excel portfolio optimization solutions in the Financial Markets section of the Excel Business Solutions Directory. Portfolio Risk and Return Analysis with Array Math in Excel Here we translate from formula notation to linear algebra because that is where institutional-level firms scale portfolio calculations. The analysis also helps in proper resource / asset allocation to different elements in the portfolio. Five valuation model are available, along with Piotroski, Dupont, Altman Z-score and earnings power analysis. It was created in 1968 by Boston Looking for a primer on how to create and work with array formulas in Microsoft Office Excel? You've come to the right place.

Com) that can be used to solve general optimization problems that may be subject to certain kinds of constraints. Investors should look at all of their accounts as a unified portfolio to construct a portfolio that is low cost, well diversified, and tax efficient. Microsoft Excel template-based software help creating project plan easy. So, you may think it makes sense to use Excel for project portfolio management and resource management.

The Excel Price Feed Add-in can help you build and maintain an investment portfolio spreadsheet with live financial data. Continue reading "Using a Stock Trading Simulator in Excel" Berkshire Hathaway Portfolio Tracker. The Hoadley Finance Add-in for Excel includes sample sheets for each of the functions in the Add-in.

We will use Sprint stock (symbol: S ). The Constrained Portfolio Optimization spreadsheet uses a Microsoft Excel template-based software help creating project plan easy. For attracting and investing funds in a business, the investor needs to carefully study the domestic and foreign markets. The Finance Add-in for Excel also includes functions for the analysis of options and other derivatives. Be sure to create a general spreadsheet as you will be graded by the accuracy of your spreadsheet for the 8 computations below with a change in some or all of the following: Portfolio Weights, Probabilities, Asset Returns. It is simply a matter of dumping your A/R 4 "Cost basis and profit" which I prepaired manually that is very cumbersome.

What is strategic portfolio analysis? View Essay - Portfolio Analysis Excel from BBA 10 at American International University Bangladesh (Campus 5). Com but wanted it for analysis in excel, thats where I find your tool most useful. Go to the quotes page and search for S using the old quotes tool (the newest version does not yet have historical prices): Next, click the “Historical” tab at the top right of the quote: Next, change the “Start” and “End” dates to the time you want to Using Excel Portfolio Sofware. Guru data with customized views. Financial Ratios: In this step, the 10-year data available in Excel will be used to calculate financial ratios.

2 A Power BI license may need to be acquired separately for certain scenarios. Portfolio applications with EXCEL Solver. There are various highly effective functions for this type of Excel tool, and also some pitfalls that you ought to avoid. View Essay - Portfolio Analysis Excel from BBA 10 at American International University Bangladesh (Campus 5). It's as easy as typing text into a cell and converting it to the Stocks data type. Excel's Whether you want to track an existing portfolio, use Excel functions to inform selling, or track stocks on your watchlist to know when/if to buy, you can use All types of investors can benefit from an investment tracking spreadsheet.

A portfolio can be viewed as a combination of assets held by an investor. This is a very simple example many different analysis functions are available, and there are many different ways to generate random data in a model. By contrast, this book does nearly everything in plain vanilla Excel. The RiskAPI Add-In is an installable Excel software component that allows spreadsheets to communicate with the remote RiskAPI (Risk Application Programming) service. First, a new blank spreadsheet in Excel.

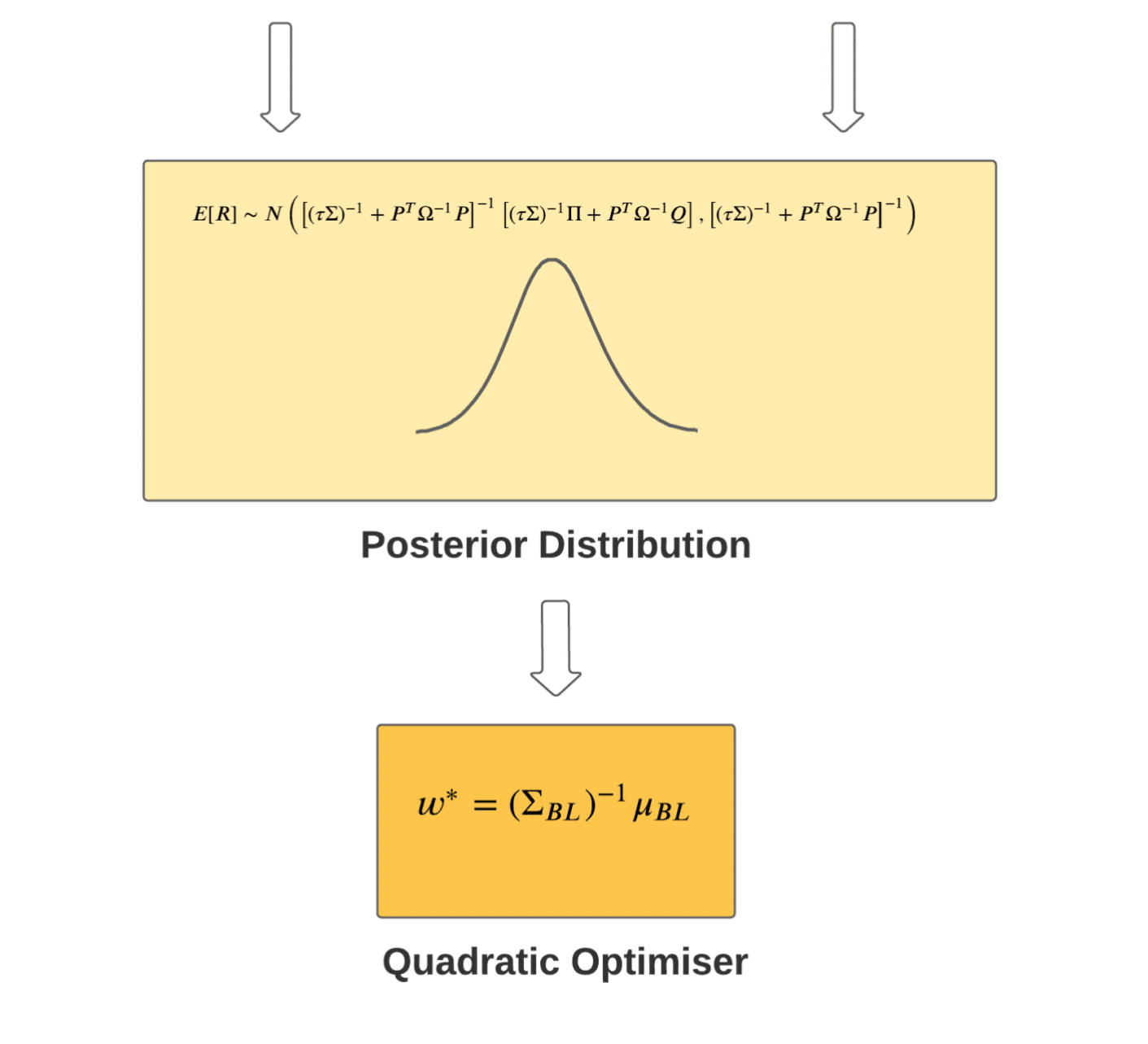

These free excel spreadsheets are related to business finance, including valuations, cash flow models, forecasting, and fundamental analysis. The book opens the black-box and reveals the architecture of risk-modeling and Excel Portfolio Performance Tracking Template, Excel Multiple Regression Analysis and Forecasting Template: Find more Excel portfolio optimization solutions in the Financial Markets section of the Excel Business Solutions Directory.Excel-based software application for estimating portfolio returns and performing asset allocation using the Black-Litterman model.

0 kommentar(er)

0 kommentar(er)